RPC assists plaintiffs and defendants in business interruption litigation. RPC’s accounting, economic and statistical consultants prepare expert analysis for mediation or trial. This blog is an introduction to business interruption insurance concepts for attorneys new to this type of litigation.

Business interruption (BI) insurance is a form of first party property damage insurance coverage. Unlike property insurance which covers the physical damage to a business, BI policies are a safety net to preserve the continuity of the insured’s earnings when a business is partially or totally precluded from using their insured and affected property to conduct business. BI policies were developed to sustain businesses during recovery efforts and sometimes extend indemnity while an entity regains customers and market share.

These policies first began in the late 1700s when standard fire policies would not cover loss of income or profits.[1] Later, endorsements were added to cover loss due to natural disasters (such as hurricanes or tornadoes), explosion, riot, civil commotion, aircraft, vehicles, theft, vandalism, falling objects, glass breakage, landslides and water damage.[2] Upon inception, BI policies were designed to cover physical damage to property of the insured. However, BI insurance can now be obtained with coverage extending in the event of damage to a third-party location, such as a supplier. Additional coverages can be obtained and are described in the BI Supplemental Coverage potion of this memo.

BI coverage can vary substantially across policies. Although BI coverage has adopted ISO form language similar to standard commercial liability policies, variation still exists. For example, definitions of “physical loss” contain different language in property policies and BI polices. In the case of a property policy which includes property coverage and BI coverage, a requirement for loss of damage may apply to property coverage but not to the BI coverage side.

Although versions of BI coverage vary, common requirements include[3]:

- Physical damage to property

- Loss arising from an insured peril

- Loss prevents, suspends or reduces the business ability for the business to operate

- Coverage continues only for a necessary (theoretical) time period required to repair the property.

Requirements for BI Coverage

As stated above, BI coverage usually requires a “direct physical loss of or damage to property.” This term is not typically defined in the policy and has therefore been defined in practice to mean that there has been “some physical change” to the character of the property.[4] This is easy to determine in the event of a fire or tornado, but it can be a difficult burden for a policyholder to produce proof of when damage is not as apparent. For example, National Children’s Exposition Corp fought a denial of coverage when they filed a claim after a snowstorm prevented attendance at one of their expositions. The court found that there was no coverage under this policy because there was no physical damage to the facility in which the event took place. Further, the exposition was able to remain open during scheduled times.[5]

Damage causing loss must be insured under the policy meaning that it must be caused by an insured peril. For example, if a policy excludes flood damage, a policyholder will be denied BI coverage in the event of a flood. Additionally, the damage must be “caused by or a result from a Covered Cause of Loss.”[6] This places a burden on the policyholder to demonstrate a “causal nexus” between the loss and property damage.[7] This was addressed in a case after the eruption of Mount St. Helens left a motel buried in 6 feet of ash. The court refused to extend coverage for BI losses because “…damage to landscape or shrubbery did not directly result in a business interruption loss. The motel had the same number of rooms available bother before and after the eruption; none of the motel rooms were unavailable because of ash damage.”[8]

Another typical requirement for BI coverage is that a “suspension” of policyholder’s operations must occur. Disputes have arisen in cases where a fire destroyed a restaurant in a hotel. A hotel claimed a loss in earnings as a result of the fire. However, the court did not agree because the hotel was still able to accommodate the same number of customers, despite a reduction in the actual number of customers.[9]

Periods of Indemnity

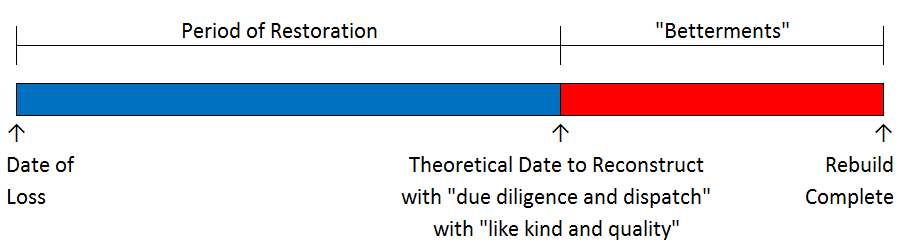

The time frame for coverage of losses is referred to as the “period of restoration.”[10] Definitions of this time vary but typically begin when the property loss occurs (plus a waiting period) and end when property can be repaired, rebuilt or replaced at a “reasonable speed.”[11] Courts have defined “reasonable speed” until a time when the business could be repaired to the same or equivalent operating conditions that existed prior to the loss.”[12] Therefore, a period of restoration does not rely on actual time, but instead a “theoretical” time period, based on a hypothetical rebuild. A sample timeline of the Period of Restoration is below:

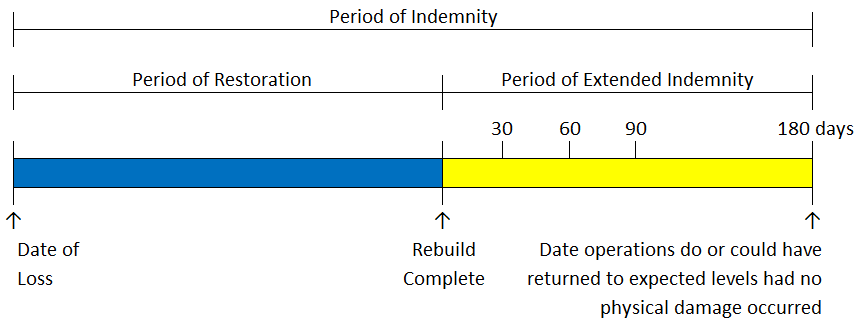

An “Extended Period of Indemnity” (EPI) can be obtained to sustain losses beyond the period of restoration. EPI can fill this gap in coverage within a specified time. The specified time is driven by type of industry and operations. It is normally between 30 and 180 days but some can be as long as 365 days. A sample timeline of the Period of Extended Indemnity is below:

Covering Losses

BI is fundamentally designed to ensure operating income lost and necessary continuing costs and expenses incurred while the business is being restored. Typically, BI coverage calculates loss to business income based on[13]:

- Net Income before direct physical loss or damage

- Likely Net Income if no physical loss or damage had occurred, but not including any that would likely have been earned as a result of an increase in volume of business due to favorable business conditions caused by impact of the loss on customers or other business.

- Operating expenses that are necessary to resume “operations” with the same quality of service prior to physical loss or damage

- Other relevant sources of information such as final records, bills, deeds, contracts, among others.

Calculated damages must be proven with “reasonable certainty,” placing a burden on policyholders to demonstrate loss through summaries of calculations which often employ the services of forensic accountants to measure loss. Summarizing a loss from an imaginary universe in which no such loss occurred can be challenging and are further complicated in instances where widespread damage causes losses to the overall economy.

Sub-limits, deductibles and waiting periods vary among polices and can complicate BI claims. Analyzing provisions early on in the claim process can help mitigate the interpretation of these policies. For example, waiting periods require BI losses to not be recoverable until after a specified time (“Period of Restoration”). It is not always clear if waiting period are applied to business, calendar or “normal days.”[14]

Actual loss due to the suspension of business operations, expenses to reduce loss verses extra expenses are also examples of common disputes in BI claims. More details of these terms and examples of past disputes can be found on pages 5-7 of Appendix 1.

BI Supplemental Coverage

Property damage is a common situation in which these concepts apply to BI coverage. However, other extraneous causes warrant extensions to BI coverage.

Contingent Business Interruption

One common extension to BI coverage is Contingent Business Interruption (CBI). CBI protects income losses to property owned by third parties of the policyholder. Recovery for these “dependent properties”, such as suppliers, vendors, or critical customers avoids pitfalls that come when a policyholder is unable to secure supplies or sell its goods.[15]

Civil Authority Coverage

Another extension to BI coverage is Civil Authority Coverage. This type of extension allows coverage when access to the insured’s property is impaired or prohibited due to an order of civil authority.[16] These are government-initiated actions that prevent or prohibit access to the insured property, such as evacuations or curfews. Commonly, a claim for this coverage must demonstrate the action of civil authority cause the loss, prohibited access to the premises of the insured, caused by a direct physical loss of or damage to property other than the described premises and the loss or damage to property was caused by or resulted from a covered cause of loss as set forth in the policy.[17]

Ambiguity can exist when debating whether or not the loss of income was the results of an “action of civil authority. This was seen in the terrorist event of September 11, 2001. In one case, a policyholder was scheduled to hold a tradeshow in the Javits Convention Center. The center canceled the show after they entered into an agreement with FEMA and the City of New York. The court ruled in favor of the insurer claiming the policyholder could not prove the center was closed by virtue of a “command or mandate.”[18]

In a dispute between a policyholder and Assurance Co of America, the policyholder (a hotel group) claimed the Federal Aviation Administration’s (FAA) closure of national airports after the terrorist attacks of 9/11 caused interruption losses to their New Orleans hotels. With the forced closures, the policyholder argued nobody could fly to stay at their hotels. The court disagreed and stated that customers still had access to the hotels by car and the order prohibiting flights did not prohibit access to the hotel.[19]

Disputes also arise with this coverage regarding whether the civil authority action is a response to “property damage.” This can be seen in the case of Hurricane Rita where a judge ordered closure of Wharton County, Texas due to the threat of the hurricane approaching. Since the hurricane did not actually strike the county, the court found the coverage did not apply.[20]

Ingress/Egress

Similar to Civil Authority coverage, Ingress/Egress coverage protects a policyholder from losses when insured property is impaired but this type of coverage does not require an order from civil authority.[21] A case example of a dispute referencing this type of coverage occurred when Hurricane Floyd caused heavy rainfall over eastern North Carolina. In the aftermath of the storm, roads were closed, displacing a boat manufacturer company and causing a 66 percent reduction in their business production. The company’s insurer paid certain claims under the policy but partially denied the claim for ingress/egress coverage, claiming that there was no actual property damage to recover under this provision. The court disagreed, stating the contract under insurance had no requirement of physical loss to property regarding BI coverage under the ingress/egress clause.[22]

Service Interruption (Utility)

In the event of third-party damage to off-premises utility service interruption, some or all of the excluded utility service interruptions that are common in most property policies are bought back under the Service Interruption (Utility) provision. Damages must be caused by a covered peril under this provision, which has caused some dispute in court. In one case, hurricanes in North Carolina caused rising floodwaters, which prompted the electrical company to cease power transmission. As a result, a bagel shop filed claims for a loss of income and food spoilage. The insurer denied claims under this coverage, claiming that the loss was not an “accident”, which was a policy requirement. They contended that, since the power company chose to shut down power, the damage was no accident. The court agreed with the insurer, reasoning that, “the cessation of the transmission of electricity was not an accident as defined in the insurance policies.”[23]

Rental Value & Rental Income

Anticipated rental income and charges from tenants, as well as payroll and other charges which would normally be paid by the tense (less expenses), is covered under the Rental Value provision. Under this type of coverage, loss of “rental value” must be caused by a direct physical loss or damage to the premises as a result of Covered Cause of Loss.[24]

COVID-19

Insurance companies are declining to accept COVID-19 as an acceptable loss, citing that one cannot show a physical loss to property because they cannot prove the virus physically penetrated inside the property.[25] They also cite policy exclusions, such as virus exclusion or fungus, bacteria/microbe exclusion. Many BI policies have disease exclusions but they vary. In past cases regarding asbestos, many courts have stated that this is a direct physical loss to the property, so there is room for debate that a virus could be included within this line of thinking.

It will matter what the language of a policy states when these claims are challenged. It will also be important for the policyholder to review local authority orders. For instance, the Dallas county’s March 22, 2020 Stay Home Stay Safe order states the virus is physically causing property damage because of its ability to physically attach to surfaces to a long time.[26] This may help an argument that a government order to shut down the premises equates a physical loss. Some states, such as California, are introducing legislation to nullify virus exclusion, using this argument.

Conclusion

BI insurance is not black and white. Individual policies vary and ambiguity in coverage exists. Reading the policy and noting timing, available coverage and deductibles, exclusion, limits and sublimits is important. It is important to establish a multi-functional team that can property examine risk management/business continuity, accounting/finance, marketing/public relations, operation and legal advice.[27]

Calculating Economic Losses in BI Cases

Lost Profits in BI cases are defined as the revenues or sales lost as a result of a covered interruption minus the variable costs avoided by not having to produce a good or provide a service.[28]

Lost Profit = Lost Revenue – Avoided Variable Cost

Fixed costs, also known as overhead expenses in accounting, are usually ignored in measuring lost profits.

The process of calculating lost profits is:

- Estimate revenues that would have been received but for the covered event (projected revenue minus actual revenue)

- Estimate associated costs with the level of production lost due to the event

- In some cases, estimate any changes to fixed costs as a result of the event

- Determine the period of loss (this may occur through estimation or based on the testimony of an expert on the physical damage and repairs)

- Calculate lost revenues minus avoided costs for the loss period

Calculating economic loss in BI cases may require the assistance of both accounting and economic experts. Accounting expertise may be required to parse through business records to accurately calculate costs and to associate costs with productive inputs. Economic expertise may be required to parse variable from fixed costs and to forecast “but for” levels of production and revenues. This forecasting may involve accounting for seasonality in sales and productions, production growth or decline which predates the loss period, and economy-wide fixed effects during the loss period. Production and revenue forecasts may be used to determine the period of loss when it extends beyond physical repairs or rebuilding.

[1] McLaurin, J. An Overview of Business Interruption Insurance. State Bar of Texas, 15th Annual Advance Insurance Law, Chapter 10, June 2018, page 1.

[2] Roach, N. & Miller, C., Primer on BI Insurance Claims and COVID-19- Paper, 2020

[3] McLaurin, J., 2018, op. cit., page 1.

[4] McLaurin, J., 2018, op. cit., page 1.

[5] AFLAC Inc. v. Chubb & Sons, Inc., (Ga. App. 2003)

[6] Ibid, page 1.

[7] Ibid, page 8.

[8] Keetch v. Mut. Of Enumclaw Ins. Co, (Wash. Ct. App. 1992)

[9] Ramada Inn Ramogreen, Inc. v. Travelers Indem. Co. (11th Cir. 1988)

[10] Ibid, page 1.

[11] Ibid, page 2.

[12] Ibid, page 2.

[13] McLaurin, J., 2018, op. cit., page 3.

[14] McLaurin, J., 2018, op. cit., page 5

[15] Ibid, page 11.

[16] Ibid, page 12.

[17] Ibid, page 12.

[18] Penton Media, Inc. v. Affiliated Ins. Co., (N.D. Ohio Aug. 29, 2006)

[19] 730 Bienville Partners, Ltd. v. Assurance Co. of Am (E.D. La. Sept. 30, 2002)

[20] South Texas Medical Clinics, P.A. v. CNA Financial Corp., (S.D. Tex. Feb. 15, 2008)

[21] McLaurin, J., 2018, op. cit., page 14

[22] Fountain Powerboat v. Reliance Ins. Co. (E.D. N.C. 2000)

[23] Bagelman’s Best, Inc. v. Nationwide Mutual Ins. Co. (N.C. Ct. App. Dec. 7, 2004)

[24] McLaurin, J., 2018, op. cit., page 16

[25] Roach, N., 2020, op. cit.

[26] Ibid

[27] Joyce, E., Szelc, R., Lamb, L., Complex Business Interruption Claims: What to do When Disaster Strikes, RIMS, 2016

[28] Foster, Carroll and Robert Trout. “Computing Losses in Business Interruption Cases.” The Journal of Forensic Economics 3(1). 1990.

The citations used for this blog include:

- McLaurin, J. An Overview of Business Interruption Insurance. State Bar of Texas, 15th Annual Advance Insurance Law, Chapter 10, June 2018

- Roach, N. & Miller, C., Primer on BI Insurance Claims and COVID-19- Paper, 2020

- Joyce, E., Szelc, R., Lamb, L., Complex Business Interruption Claims: What to do When Disaster Strikes, RIMS, 2016